This past week the $2 Trillion CARES Act was passed by Congress and signed into law by President Trump on Friday. The bill's intention is to provide emergency relief to a faltering economy that has been badly hamstrung by the coronavirus quarantine. The bill will go down as one of the biggest Congressional expenditures of all-time, but considering that over 3 million people applied for unemployment just last week, it is hard to argue against the merits of the bill.

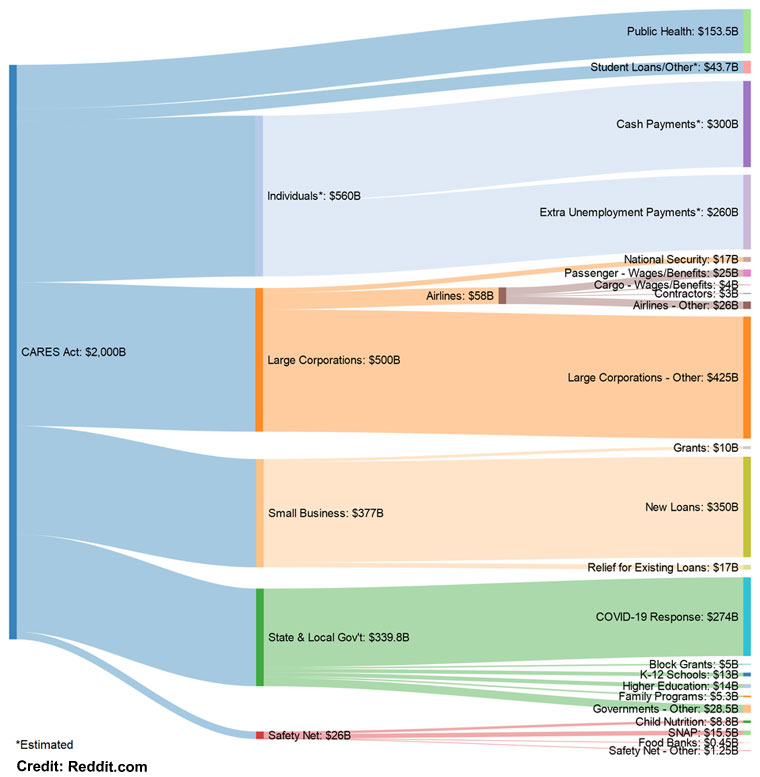

The CARES Act was broken down between relief for individuals, businesses, and even local governments that have had their operations shuddered in the pandemic. For the purposes of this article we are going to concentrate on the relief given to individuals which is estimated at $560 billion, but here is a flow chart of the full $2 billion.

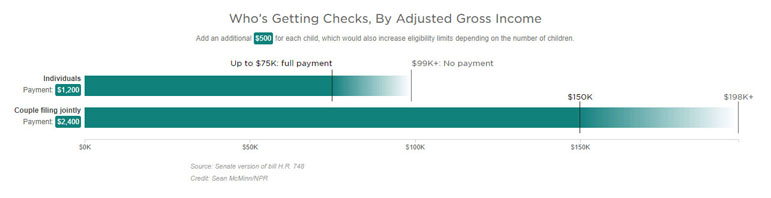

An estimated $300 billion is ear marked for immediate cash payments to individuals. This one-time payment will be $1,200 per adult and $500 per child. These payments will start phasing out for individuals making over $75k and joint couples making $150k. If your income is over $99k as an individual and over $198k jointly then you will be entirely phased out from receiving the payment.

The payment will be based off your most recently filed tax return. So, if your 2019 income was high enough to phase you out of receiving this benefit you may want to delay filing your return if you haven't done so already. Your Federal return is now not due until July 2015. However, this isn't necessarily a loophole. Technically the payment is a tax credit for your 2020 return, so theoretically these payment phase-outs will be based off how much income you have this year. If you are fortunate enough to increase your earnings in 2020 then you might be forced to payback this tax credit when you file your return next year.

Payments will be automatic and sent to the most recent electronic bank account linked to your tax return. If available, your electronic payment will be used instead of a physical check. If you have changed bank accounts in the last year be aware that the electronic payment may be going to your old account.

The remaining amount earmarked for individuals goes towards unemployment insurance. Unemployment insurance is typically handled by your home state, but this bill has added $600 per week to that amount from the federal government. This boosted payment will be good for four months. Additionally, the bill also extends the amount of unemployment allowable by 13 weeks. These are some very lucrative benefits for those who have been laid off, and they should prevent depression style soup kitchen lines.

The CARES act also provides relief through some short-term changes in retirement accounts. For early distributions out of a 401(k) or IRA the 10% early withdrawal payment is waived for qualifying

"coronavirus" distributions up to $100,000. A qualifying distribution is for anyone (1) who is diagnosed with COVID-19, (2) whose spouse or dependent is diagnosed with COVID-19, or (3) who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, having work hours reduced, being unable to work due to lack of child care due to COVID-19, closing or reducing hours of a business owned or operated by the individual due to COVID-19, or other factors as determined by the Treasury Secretary. However, don't forget that distributions from tax-deferred retirement accounts may be penalty free, but that doesn't mean tax free. You will have to recognize the withdrawal amount as ordinary income; although it can be spread over the next three tax years or paid back into the account in the same timeframe to avoid taxation. Also, required minimum distributions (RMDs) have been eliminated this year for all retirees and for those with inherited IRAs.

The immediate cash relief provided by the CARES Act is some unprecedented action taken by Uncle Sam. Ideally the worst of the pandemic is in the rear-view mirror a few months from now. This cash stimulus, newly minted 0% interest rates, and a stir-crazy population should provide the kindle to ignite one of the greatest economic recoveries in modern US history. Ideally the CARES Act bridges us long enough to get there.