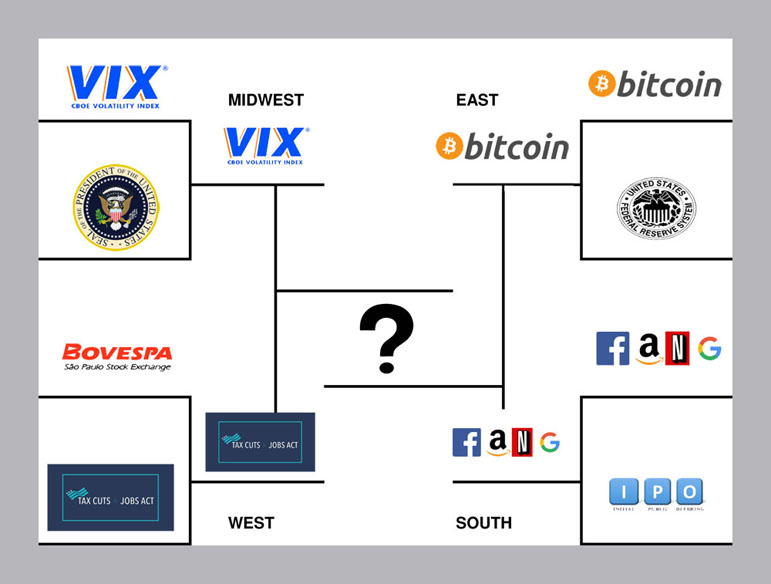

What a crazy year of epic upsets, shocking meltdowns, and volatile outcomes — and I'm not talking about basketball! This roller coaster of a first quarter has left nobody with a perfect investment bracket, but there's still time to position yourself correctly to claim your one shining moment by year end. With that in mind, let's take a look at the top investment themes thus far in 2018 and see which ones will advance to our 6th annual Investor's Final Four.

Coming out of the Midwest region, we have the Volatility Index (VIX) making an appearance after being absent from last year's tournament. The VIX is the market's so-called "fear gauge", and it hit an all-time low in 2017 and produced a year of record low volatility. So far in 2018, the exact opposite has come to pass. We've seen 7 moves of 20% or more in the VIX in the first quarter, which is the most ever. On the opposing sideline we have perhaps an equally volatile team led by Coach Trump. POTUS takes credit for the impressive run in the Markets last year, but his coaching style has also contributed to the erratic flow of equities so far in 2018. While his program is still under FBI investigation, look for more staff turnovers and more zone coverage tariffs on defense to stifle POTUS's run deep into the tourney this season.

In the East, we have a perennial powerhouse under new leadership. The Federal Reserve has a new coach as of February, and Chairman Jay Powell has started off his tenure by following the playbook of his predecessor. Having eased off the full-court printing press of years past, the Fed now has taken more of a ball "hawk" defensive style. The Fed raised interest rates three times in 2017 and consensus points towards a repeat performance in 2018. This steady boring style of defense should curtail inflation, but leaves them susceptible to an upset early in the tournament. Enter bitcoin — making its first appearance in the investor's bracket. This crypto-currency is making headlines all over the world in 2018 and becoming a phenomenon that no one can ignore. While the meteoric rise since its founding in 2009 has caught significant attention, what garners the most consideration this year is the continued volatility and massive decline in value. From its peak in January, bitcoin dropped nearly 60% by early February. Stay tuned for more gaudy headlines, and don't be surprised to see an epic shocker like UMBC's dismantling of UVA.

In the South region we have a matchup between the old guard and a relative newcomer. So far in 2018 we've seen a resurgence in initial public offerings (IPOs). Especially those of the so-called unicorn variety. These once private companies with $1 Billion or more valuations, such as Dropbox, Spotify, etc. have come to market with a lot of hype and delivered hot shooting in their first quarter of trading. On the flip side, the bluebloods of FANG (Facebook, Amazon, Netflix, and Google) have been underwhelming this year after providing market leadership in 2016-17. Talk of regulation in the computing world of data has investors spooked temporarily, but we wouldn't be surprised to see FANG return to top form before the year ends.

Finally, in the West we see a surprising top seed. The Bovespa, or Brazilian stock exchange equivalent of the S&P 500, is the best performing global index through the end of the first quarter. Don't bet too much on this Cinderella story as most pundits think it will be difficult to replicate the 11.73% year to date performance in later rounds. Their opponent, The Tax Cuts & Jobs Act (TC&JA), enters the field after making a buzzer beater in the conference tournament at the end of 2017. The lowering of both individual and corporate tax rates pursuant to the TC&JA should start to yield returns in the markets and economy in 2018. Hopefully, the stimulative effect will be more than just a handful of bonus free throws. However, we've yet to see how investors and companies will use the extra cash in their pockets. Either way, we still expect a positive outcome for investors that stick to a diversified approach.