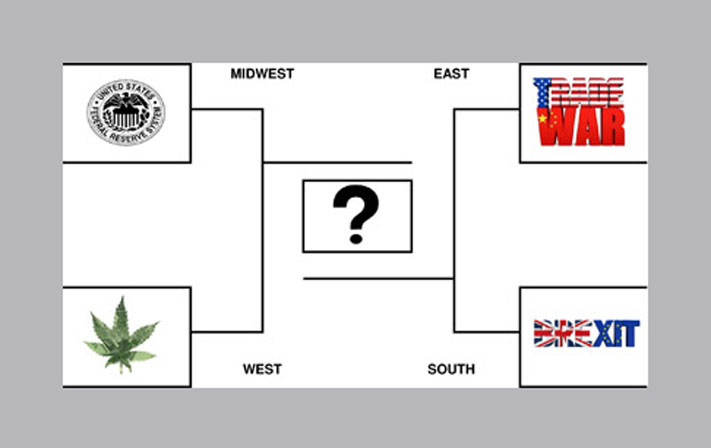

For the first time in a while, it feels like investors have had a perfect bracket through the end of the first quarter. Much like the NCAA tournament, the favorites are leading a "chalk" bracket with U.S. stocks posting a 13.65% gain. This is quite a rebound from an awful fourth quarter performance in last years tourney. Many pundits would probably like the big dance to end right now and claim their one shining moment. However, there is more time left on the clock and the outcome is still undecided. With that in mind, let's take a look at the top investment themes so far in 2019 and see which one will have the biggest impact on your portfolio moving forward.

Coming out of the Midwest region, we have the undisputed number 1 seed. The Federal Reserve has once again secured the top spot under the leadership of Coach Powell. In the past 6 months, the Fed has roiled markets with its flip-flop on monetary policy. This strategy change from a ball "hawk" defense to something more akin to a softer zone coverage has once again given life to all asset classes. However, fears of slowing economic growth have caused the dreaded yield curve inversion. This harbinger of imminent recession is definitely something to watch, and the President may look to appoint a new assistant coach soon to try and make sure the Fed once again reverts back to the full-court printing press.

Coming out of the West is a high flying mid-major that is making its first appearance in our bracket. With the trend towards legalization of marijuana for medicinal and recreational use in the US and abroad, cannabis themed investments are burning down the nets with their hot shooting — up about 50% to start the tournament. While the potential long-term revenue growth of this consumer segment has enamored investors, in the interim, profits are non-existent. Those wishing for the ultimate Cinderella story will need to be patient and perhaps lock in some of those gains before their tourney hopes go up in smoke.

In the East we have another new contender that continues to impact the global economy. The trade war between the U.S. and China has entered overtime after both parties failed to reach a substantive agreement ahead of the self-imposed March 1st. deadline. Although both sides seem to be getting closer to a deal that will address trade imbalance, government subsidies, market access, and intellectual property, the lack of clarity continues to keep markets on edge. The key to a resolution may be finding a referee that can enforce the rules and keep both sides from getting a double T (Tariffs and Tweets!)

Coming out of the South we have "Brexit" squarely back in the news and on investors' minds. Dating back to the original vote in 2016, the United Kingdom (UK) and the European Union (EU) have kept International markets under wraps as they try to negotiate an amicable divorce. Unfortunately, this game has also entered overtime, and Coach Theresa May can't even quit her job to pass the deal. With no easy path towards resolution ahead of the abrupt April 12th EU deadline, this game could get ugly. Look for errant shooting by either team as an opportunity to invest long-term in what has been an under-weight asset class.