Overnight we saw some of the wildest market action since the depths of the banking crisis in 2008. The Coronavirus (COVID-19) has obviously been steering headlines the past few weeks, but over the weekend the oil market decided to take the wheel. After a lack in consensus at OPEC on production cuts, Saudi Arabia has decided to fire a shot over the bow at the competition and increase production. This caused complete chaos in an already weak space making oil futures collapse 30% over night.

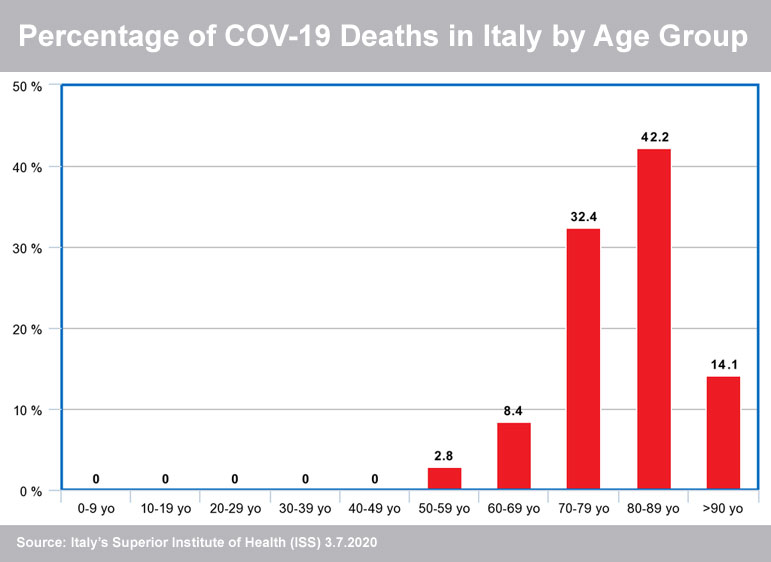

We wrote last week about COVID-19 (www.tarheeladvisors.com/blog/coronavirus-infects-stock-market.html), and not a lot has materially changed in regard to the outbreak since then. We are starting to see some further insight on the segments of the population that are most vulnerable to the virus. For example, in Italy the average age of those dying from the COVID-19 is over age 80. According to their data it appears to be mostly non-lethal to those under age 50.

However, there is one thing that has been getting up there in age over the past decade, and that is the bull market here in the US. We have had multiple sell-offs that were essentially 20% on the dot (2012 & 2018), but this time around it is starting to feel like the Coronavirus will be taking the life of this old bull.

The economic impact of this outbreak seems to be spreading faster than the disease itself. The part of the economy that appears to be most susceptible is the world-wide travel industry. Cruise stocks and the airlines have been devastated in the past month with many in the sector down over 50%. The cruise industry has already seen multiple outbreaks on ships overseas that were badly mismanaged, and as would be expected, this has led to a flurry of cancelations and deep discount offers to keep vacationers.

Last week we lowered our GDP growth estimate for the year down to 2%, and with the economic damage we have seen just since then, we feel we are looking at closer to a 1% print for 2020. The February jobs number in the U.S. from last week was extremely strong with a gain of 273,000 new jobs; so, we are working from a point of relative strength here in the U.S. However, we may see Q2 come in negative, and possibly even significantly so, based on a huge decrease in the travel and leisure industry.

According to two-year old data from the St Louis Fed, entertainment, arts and recreation make up close to $90 billion in economic activity annually in the US, which is just under 1% of overall activity. After 9/11, this sector saw a 10% haircut in production, and in the first half of 2020, it is likely to see a similar decrease. While the sector is relatively small in in the US, it makes up a significant portion of GDP in much of Europe. Even though much of the economic pain will be centered around a single industry, the damage is likely to have reverberations around the entire economy over the next 3 months.

Naturally, we are seeing a bit of an overreaction currently to COVID-19, and a rash of event cancelations and extra precaution will abound for at least the remainder of March. However, in our initial analysis of this virus we compared its impact to a severe flu season, and nothing has occurred to change our mind in that analysis. Dr. Scott Gottlieb, a former commissioner of the FDA, has said, "We are past the point of containment." That is a serious issue for retirees and those over age 80 who are very vulnerable to the virus. However, for the bulk of the working class in America, we expect things to be business as usual by Summer which is around the corner.

Markets will continue to be hectic today, and most likely for the weeks to come as we digest the new economics of COVID-19. If we see a 20%+ haircut in stocks, I think we are looking at an amazing long-term buying opportunity. The current economic issues appear to have little power to do long-term destruction here in the US or abroad. When markets recover, they will be doing so on a repeat of zero percent interest rate steroids, creating another rush to risk assets like stocks.