Higher interest rates, a banking crisis, and the slow spread of war across the globe...all things that one would expect to be a recipe for disaster in stocks. However, most equity indexes ended up double digits for the year, and the Nasdaq tech-heavy index went up a whopping 52%. 2023 was a statistically great year, proving that investment returns don’t necessarily mirror the underlying news cycle.

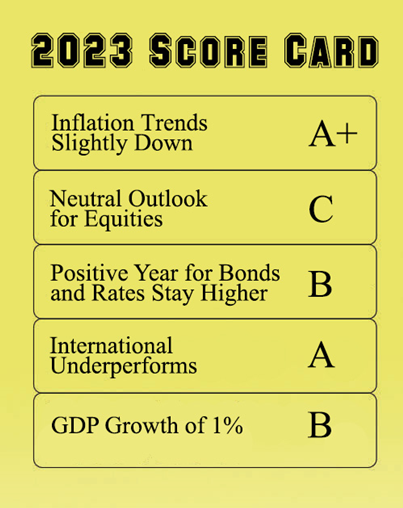

Year in Review– Our primary thesis for this past year, and much of the last decade, has been that the Federal Reserve’s policy on interest rates has been the most significant driver of investment returns. Accordingly, we felt inflation would trend down from generational highs but remain above the Federal Reserve’s (Fed) target of 2%. We thought this environment would give the Fed very little wiggle room to pull back on interest rates and that borrowing costs for everyone would remain elevated for longer. Our assumption was spot on, as year-over-year inflation pulled back significantly during 2023 (from 6.5% to 3.1%). The downtrend in inflation caused the Fed to pause further interest rate hikes midyear and hold steady at 5.5%.

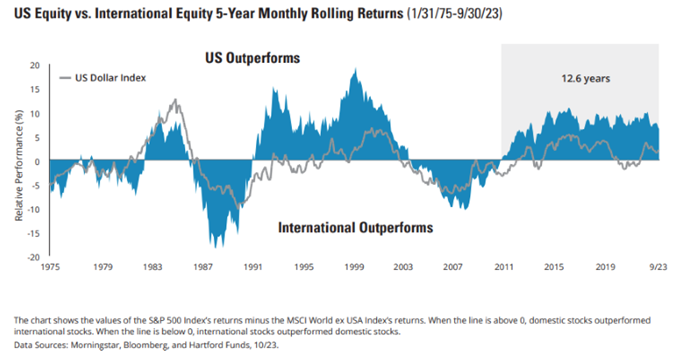

Where we could have been more accurate was in our outlook for equities. We came into the year neutral on equities, expecting positive returns, unlike 2022, but thinking that higher interest rates would create a bit of a headwind. The appetite for stocks would outweigh this sentiment coming out of a bear market. Led by the largest companies in the U.S., stocks pushed through a fall sell-off and closed the year up double digits. The buzzword for the year was Artificial Intelligence (AI), and anything that was perceived to have a ball in that court was rewarded, whether or not that ever affects their bottom line. On the flip side, the banking and utility sectors severely underperformed. International stocks did well directionally but underperformed again relative to domestic stocks.

It is easy to forget at this point, but we experienced a banking crisis just nine months ago that caused three of the largest bank failures in U.S. history (Silicon Valley, First Republic, and Signature Banks). The banking crisis was directly related to the direction of interest rate moves and the multi-year selloff in long-term bonds. Perhaps this played into the Fed’s playbook and was another reason to only hike rates four times in ’23 versus seven times in ’22. Either way, bonds did as we expected and produced positive returns, most of which materialized in the last two months of the year.

We suspected real estate would be another victim of high interest rates. With mortgage rates hovering around 7% and hitting a high of 7.8% in October, we expected and saw a very stagnant housing market. Many homeowners with sub-4% mortgages are hesitant to move and jump into a new property with a much higher payment. This stagnation has resulted in historically low volumes for home sales and refinancing. Housing pricing shrugged off the low volumes and stayed fairly strong for the year in the bulk of the country.

2024 Predictions– Once again, we are basing our 2024 market thesis on the Fed’s interest rate policy. Since the Fed’s December policy meeting, market pundits have started predicting anywhere from 3 to 6 quarter-point rate cuts in ‘24. This conjecture is based on what is known as the “dot plot” forecast, which is a chart updated quarterly that records each Fed official’s projection for the central bank’s key short-term interest rate.

We are going against the consensus, and we expect rates to only be cut by a half of a percent this year. With an unemployment rate of 3.5% and positive GDP growth in the last four quarters, it seems unlikely that the Fed would risk re-igniting inflationary pressures. As we argued in last year’s article, inflation is not transitory. It wasn’t just caused by the supply/demand imbalance coming out of the Covid re-opening of our economy. There are a lot of factors to blame, including the irresponsible long-term government spending by most of the developed world. That side of the ledger has not changed recently and is unlikely to change, especially in an election year, where whatever party is in control typically uses all the resources they can to juice the economy and improve their re-election chances. With that in mind, if rates are not cut as many times as expected, then some of the recent double-digit resurgence in the equity markets is likely just pulling future returns forward. Thus, we remain neutral on stocks but still expect positive returns.

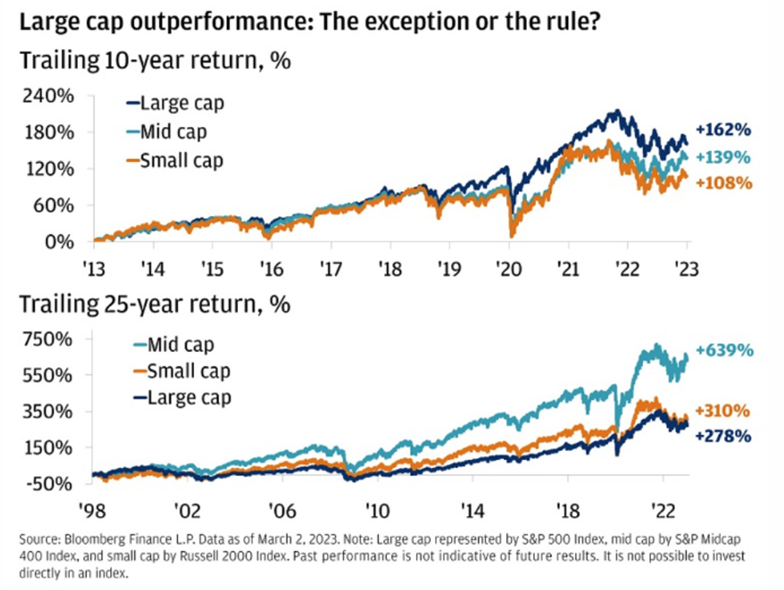

We don’t think that every asset class is created equal. We’ve written about this over the past five years, and we have cast aside sectors such as international bonds and emerging markets. While large-cap domestic stocks have been the beneficiary of many societal shifts since 2020, we don’t think this relative out-performance will continue unchecked. Even less than expected, a reduction in interest rates should benefit small-cap and mid-cap companies by reducing borrowing costs. Couple that with a reversion to the mean for valuations and historical returns, and we anticipate outperformance.

Along those same lines, international stocks have been out of favor for more than a decade. There are several significant reasons for this underperformance, including much higher corporate taxes and regulations abroad, lack of tech-centered businesses, and a weakening currency. Many of those factors haven’t changed, but the euro/dollar relationship has finally shifted. After reaching its lowest point since 2008, the exchange rate has now switched direction, and the Euro appreciated against the dollar in 2023. If the Fed lowers interest rates in ’24 and the European Central Bank (ECB) maintains or further hikes their official short-term rates, then we will likely see a continuance of this trend. And while not having as many tech-oriented businesses hurt returns in ‘23, and throughout the last decade, a shift towards value and dividend stocks could reverse the international stock market’s abysmal underperformance. However, the periods of outperformance for the international sector have been relatively brief and shallow, so we will be inclined to sell into strength in this sector.

Another direct result of our interest rate thesis is that bonds will perform well but won’t have above-average returns. Short-term treasuries with yields of around 5% are worth including in your portfolio as a great risk reducer. A year ago, the 60-40 portfolio was declared dead, but now bond investors should expect annual returns between 4-6% going forward.

Lastly, this year has the potential to be one of the most toxic political environments in modern U.S. history. So, buckle up and expect some volatility in the stock market. As various candidates drop out or seem more likely to succeed, investors will likely take out their frustrations on the stock market. Use that as an opportunity rather than a reason to panic. We’ve written about this innumerable times in the past, but it is always worth re-iterating. The political party controlling the White House and Congress is not a good predictor of investment returns. Instead, follow the breadcrumbs left by the Fed’s interest rate policy, which are much more likely to keep you on the trail to solid long-term investment returns.