I had an AI-inspired epiphany this morning before starting this article. Our office bathroom has automated faucets and paper towel dispensers. As I was washing up, the sensor on the faucet refused to cooperate. I was left maniacally waving my hands back and forth for ten seconds before I could finally get any water out, and then it only ran for a few seconds. I then attempted to get a paper towel, but the dispenser was equally uncooperative. I ended up leaving the washroom with minimal cleanliness and maximum frustration.

This scenario is one that everyone can relate to and has experienced dozens of times over the past decade. But this time, I began to wonder, do the advancements in Artificial Intelligence fix these problems or does it further perpetrate micro robotic transgressions onto mankind for eternity?

If you ask the stock market this same question, the answer appears to be that AI will be our savior. Over the past six months, the tech-heavy NASDAQ index is up 18.3% compared to the more traditional DOW Industrial average that is only up 3.8%. The bulk of these returns have been led by AI focused chip maker NVIDIA, which is up 150% year-to-date. For a brief period last month, it became the largest company by market cap in the world.

AI has become the new buzzword in finance and beyond, but what exactly is it? The current technology that is available for use is considered a Narrow AI. These tools are used to perform specific tasks, and the programming is trained on large sets of data. Several providers have developed tools that can generate images, text, video, and even programming code. For example, say you wanted a picture of the great investor Warren Buffet working at an all-you-can-eat Chinese Buffet. Generative AI can come up with something like this in about ten seconds. Interestingly, I tried to put Jimmy Buffet and Warren Buffett in this picture, but the system failed multiple times (just like my bathroom sink).

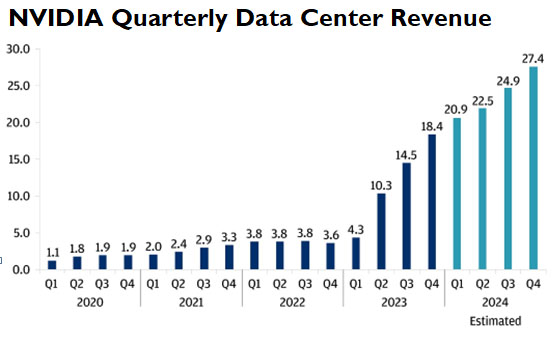

These new tools can be a lot of fun, and many current use cases will significantly increase productivity for both individuals and businesses. However, the costs of implementation with AI are not insignificant. Only the most prominent tech firms are currently able to afford the chips needed at scale. The amount of investment being deployed in this space is probably best viewed through NVIDIAs quarterly data center revenue growth. In 2022, this was an annual revenue source of $15 billion, and in just two years, it has exploded to a $100 billion a year run rate.

The cost of AI implementation doesn’t just end with the chip cost. The power draw of this equipment is significantly higher than that of traditional data centers. According to estimates by Goldman Sachs, the power needs of data centers is estimated to increase 500% from 2020 to 2030. That could end up being as much as 10% of the power usage in the US.

A meaningful investment in AI data centers today potentially costs $20 billion or more. This is an astoundingly large number, and at some point, investors need to be asking whether the juice is worth the squeeze. In my opinion, the tools that have been currently created with AI are not worth the current implementation costs. Generative AI and improved automation tools are valuable, but I don’t see them currently as valuable as the goods and services provided by Apple, Microsoft, and Google. Other market pundits share this pessimism and are comparing the current markets to the bubble of 2000.

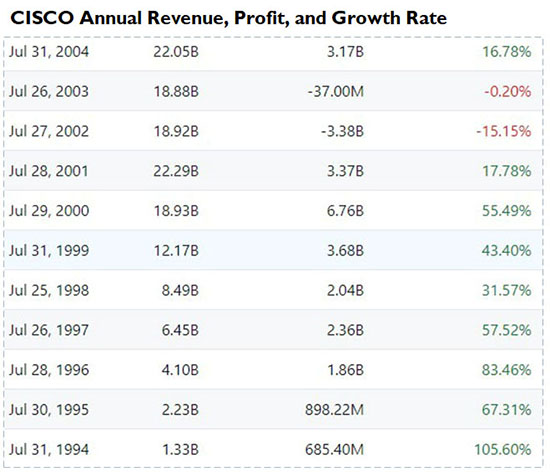

The recent run by NVIDIA best mirrors the meteoric rise of Cisco at the turn of the century. Similar to NVIDIA, Cisco at the time sold the “picks and shovels” needed to run an online business. In 2000, they traded at 97x earnings and briefly overtook Microsoft as the largest company in the world. The stock cleared $80 per share at its all time-high. However, the stock has traded below $80 ever since and was even below $10 per share 3 years after its peak. Competition came into the markets, and 50% revenue growth rates turned negative as the industry matured. Cisco continued to grow and does nearly $60 billion annually today, but the stock got ahead of itself by a magnitude of decades.

For NVIDIA to continue to climb from here, a breakthrough in General and potentially Super AI will be needed to support the costs in equipment and power usage. Current AI systems are essentially highly advanced “cut and paste” programs. They can only provide utility by automating and regurgitating existing information. The race for General AI and beyond is the race for computer systems capable of original and new thoughts and technology. It would be wise to assume that every major super power country and company in the world is currently investing heavily in this race, similar to the race for the atomic weapon.

From an investment standpoint, there are various ways to leverage this sector. Obviously, the chip makers have been the best investment out of the gate, but data center builders and the software makers using these systems are the next logical play. For example, Dell is up over 80% this year. Beyond that, the power needs of these data centers will be significant and likely less speculative for investors looking to avoid volatility.

I suggest constraint for those looking to jump into AI from both an investment and usage standpoint. We are not far removed from companies making $10 billion+ investments in virtual reality. As the verdict stands today, people don’t want to live in a completely digitized universe and are not adopting the products despite them being incredibly well made and ready for prime time. Humans need purpose and some struggle in order to thrive. Super AI systems potentially remove both of those, and there are no guarantees we are better off for it at the end of the day. My expectations (and hope) are that the adoption of AI comes at a very slow and measured pace. If I couldn’t get along with the bathroom sink this morning, I really don’t want to find out what happens when I can’t get along with an army of weaponized AI controlled drones a few years from now.