Did the market already peak for the year? Will the Federal Reserve actually follow through on its prediction for interest rate cuts in 2024? Who will win the polarizing political races in the fall, and how will it affect the markets? Does artificial intelligence have a place in my portfolio? Is gold back and better than ever? These are just a few of the questions that investors are pondering as we start the second quarter. With that in mind, let’s take a look at the biggest market forces thus far and see which one has the game to back up the hype and cut down the nets in our annual Investor’s Final Four.

Like the start of spring, stock markets around the globe have been off to a roaring start. With the U.S. stock market, represented by the S&P 500, up over 10% in the first quarter, equities are off to their best first quarter since 2019. Within the sectors and sub-sectors of the stock market, one particular niche is burning up the nets more than the competition—artificial intelligence (AI). After being the buzzword of the year in 2023, AI has continued to be on the mind of investors and corporate executives. In fact, the C-suite coaches have gone out of their way to rally the team behind the buzzword du jour and have been taking any chance they can get to talk about their AI strategy and why that makes their stock a good investment. As of the end of last year, 153 of the 500 companies in the S&P 500 had made mention of AI in their most recent earnings call. Whether or not that eventually translates into future earnings seems to be second fiddle to what the hype can do for their share price in the short-term. Undoubtedly, some companies will benefit more than others in this technology arms race, perhaps, none bigger than Nvidia (NVDA), which makes GPU chips that have more power than the more common CPU chips, and help improve the processing speed needed to run some of the nascent large language model AI applications. The stock is up 82% YTD and was up 239% last year, and it has grown to be the third largest company by market cap ($2.2T) in the U.S. Some pundits think it has more room to grow, while others decry its lofty 75 price/earnings multiple. The answer as usual, probably lies somewhere in between. Now that AI technology is out of Pandora’s box, it’s unlikely to disappear, but it is highly likely to be regulated and heavily scrutinized. Thinking back to the dot-com bubble in ‘99-00, those who thought the internet was the next wave of the industrial revolution were eventually proved right, but the timing of that thematic investment proved difficult. In fact, it took over 20 years for those who invested in the technology heavy Nasdaq 100 at the time of the crash to get back to breakeven. Taking that broad based sentiment down to individual companies is an even a better example. Just like Pets.com and AOL no longer occupy the pinnacle of the next best internet investment, many of today’s AI darlings may fall by the wayside. If I were a betting man, (and I guess it is legal in NC now), I wouldn’t wager my hard earned dollars chasing this year’s Cinderella story.

Instead of betting on a longshot, the sure thing for the last decade has been investing based on the direction of the Federal Reserve’s (Fed) monetary policy. Chairman Jay Powell has now been at the helm for eight years and was appointed by presidents of both parties to continue in that role. Whether you agree with his strategies or not, it’s difficult to argue with the results for investors. The U.S. stock market has been a bastion of stability compared to world counterparts, and investment returns have been historically stellar during his tenure. A lot of that market appreciation can be attributed to intentionally loose monetary policy where the Fed kept interest rates at essentially zero for years to stimulate the economy and counteract the negative price and employment forces due to various financial and health crises.

What we saw in 2022 was a reversal of that trend when the Fed hiked interest rates significantly and contributed to one of the worst years for stocks and bonds in recent memory. At the end of 2023, Coach Powell insinuated that the playbook was changing again and that we could expect between 3 to 6 rate cuts in 2024.

Fast forward to now, and none of those projected cuts have happened yet, and it seems increasingly likely to be at the lower end of that range. Perhaps the appearance of being apolitical in an election year is a factor. The fact that inflation remains stubbornly high is more likely behind the lack of action. Either way, investors seemingly have not cared and have driven the stock market to new all-time highs in the first quarter. However, we think you would be wise to consider locking in some of those gains now as the more time that passes without a change in monetary policy will likely lead to less free throws for investors looking to score.

Another investment force that’s been dormant for years is the precious metal, gold, which is enjoying double digit returns thus far this year. The oft-maligned yellow metal has reached a new all-time high and curiously performed well in the face of higher interest rates and competition from other so-called safe haven digital assets like Bitcoin. When rates are at zero and your cash earns next to nothing, it makes more sense that an alternative asset like gold would shine. But what about when your cash earns 5%+ and the opportunity cost of holding gold and other precious metals is much higher? Part of the explanation is likely that global central banks have started acquiring gold bullion in large quantities. China, in particular, has accelerated its desire to diversify away from their stash of U.S. dollars. Throw in a good deal of geopolitical tension due to the war in Ukraine, conflict in Israel, and a polarizing political climate in an election year, and you have the ingredients for a surge in gold. Whether or not that trend continues probably has a lot to do with the Fed playbook. However, sometimes the best defense is a good offense. So, continuing to insulate your portfolio from a stock market sell-off by keeping a portion of your assets in gold may prove to be wise.

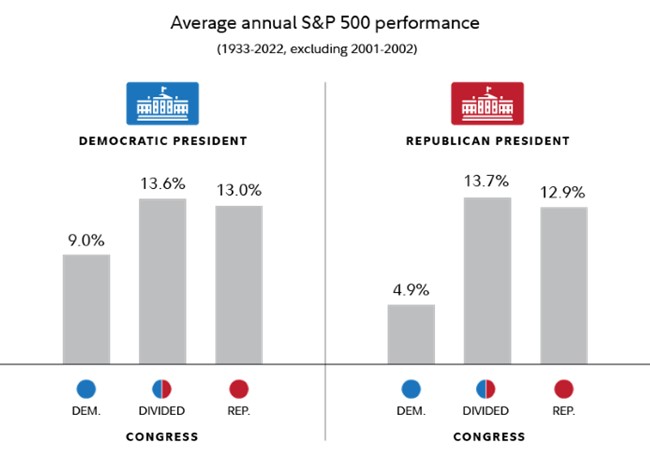

Finally, let’s talk about the elephant in the room—the 2024 election. Undoubtedly, there are some that enjoy the rancorous debate and endless political speculation, but most are already sick of hearing about the candidates and being bombarded by political ads. Much like individuals, the stock market doesn't like uncertainty, and with this nation starkly divided along party lines, it seems likely that half the population will be upset regardless of who wins the White House and control of Congress. Another way of saying this is half of investors will feel optimistic about their future and investment returns and the other half will be pessimistic. As we’ve discussed in past newsletters ad nauseum, the party in control of the Presidency and Congress is not a good predictor of investment returns. In fact, over the last 89 years, the average performance for stocks has been remarkably similar across all party control scenarios.

That said, disregard all the political noise and take comfort in the fact that since 1950, the stock market has averaged 9.1% annual returns in election years. Don’t worry about who is going to cut down the nets in November and focus on your one shining moment, which is maintaining your investment discipline and following your financial plan.