Being a landlord can be a lot like a hunt for buried treasure in a famous old Western movie. Imagine your long-term rental tenants have just finished moving out, and it is time to inspect the property and get ready for the next tenant. What kind of gifts have they left for you? Over the years, I’ve received back the good — my beloved cast iron skillet and six empty propane tanks, the bad —a missing fire alarm and back storm door, and the ugly — an armoire entirely wrapped with aluminum foil on the inside.

The idea of passive income is something in financial planning that has a powerful attraction. Many people begin to look into managing rental houses for this reason. They already own a house of their own, so having another and renting it out should be a piece of cake, right? What many find out is that it isn’t as passive as they initially were led to believe. Let’s take a look at the good, the bad, and the ugly of investing in a rental property.

The Good

Steady Cash Flow: Rental properties can provide a consistent source of income in the form of monthly rent payments. This steady cash flow can help you cover mortgage payments, maintenance costs, and still potentially leave room for profit.

Appreciation Potential: Over time, real estate properties tend to appreciate, which can lead to substantial wealth accumulation. Historically, real estate has shown a tendency to keep pace with inflation, and if you purchase in the right area, your growth can exceed inflation.

Tax Benefits: Rental property owners enjoy various tax advantages, including deductions for mortgage interest, property taxes, insurance, maintenance expenses, and depreciation. Additionally, if you plan on leaving property to your heirs, you may never pay income taxes on decades of appreciation due the step-up in cost basis at death.

Diversification: Investing in rental properties can diversify your investment portfolio, reducing overall risk. Real estate often behaves differently from traditional financial assets, such as stocks and bonds, providing a cushion during market downturns. Also, when the stock market is going crazy, you won’t have to worry about seeing your rental property go up or down 5% in value on a given day.

The Bad

High Initial Costs: Acquiring rental properties can be capital-intensive. You'll need a significant upfront investment for a down payment, closing costs, and initial property improvements. This can be a barrier for many potential investors.

Property Management Challenges: Managing rental properties can be time-consuming and stressful. Dealing with tenants, maintenance, and unexpected issues can be a significant drain on your resources and patience. You can potentially outsource property management, but it will typically cost around 10% of your rents on a long-term rental and significantly more on a short-term vacation rental.

Market Risk: Real estate markets can be cyclical and subject to fluctuations. Economic downturns or oversupply in your area can lead to vacancies and declining rental income, impacting your investment's profitability.

Illiquidity: Real estate is not a liquid asset. Selling a property can take time, and you may need to make price concessions to attract buyers, especially during a down market.

The Ugly

Bad Tenants: Problematic tenants can turn your rental property investment into a nightmare. Late rent payments, property damage, or eviction proceedings can be costly and emotionally taxing. You need to ask yourself if you’re okay with evicting a family that is a month behind on payments from your property. Remember, you’re running a business, and not all aspects of that may make you feel good in rental management.

Maintenance and Repairs: Unexpected maintenance and repair costs can eat into your rental income. Failure to address issues promptly can lead to further deterioration of your property's value.

Legal and Regulatory Hassles: Rental property ownership comes with legal responsibilities and regulations that vary by location. Failure to comply with these can result in legal disputes, fines, or even property loss.

Leverage Risk: Using leverage (borrowing money to invest) can amplify your returns, but it also increases your risk. If property values decline, you may find yourself owing more on the mortgage than the property is worth.

Bad Purchase: Most areas appreciate in value over time, but there is no guarantee of this. If you invest in a high-tax area with a decreasing population base you could end up with a property that stagnates or even declines in value. This has been the case in several large cities such as Detroit, Baltimore, and Chicago.

Recaptured Depreciation: Depreciation has great tax benefits when you own a property, but unfortunately those benefits can come back to bite you if you ever sell. All that income you wrote off over the years is likely to be recaptured and taxed if you ever sell your property. For this reason, many rental investors look to do a tax-free Section 1031 exchange of a property into a new rental property if they ever decide to sell.

So, how does all of this fit into your financial plan? I find most people get into rental real estate thinking they are doing it for the cash flow, but they eventually find out that their money is actually made in long-term appreciation.

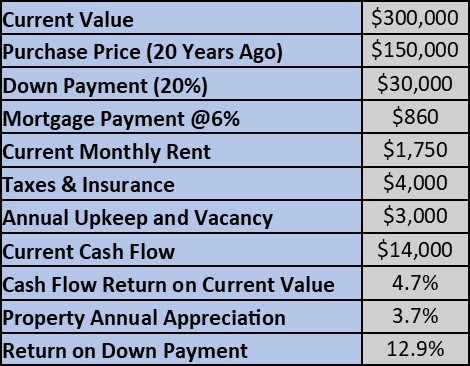

Let’s look at a real-world example in North Carolina. This particular property was purchased for $150,000 with a 20% down payment 20 years ago. With proper management over this period, the landlord is likely to have a flat cash flow (rent less mortgage, maintenance, and other expenses), but would have paid back all the principal of the $120,000 twenty-year loan, leaving the investor with a paid off home and a $14,000/year income stream moving forward. If they decide to keep the property, it will generate a cash flow of 4.7% on an annual basis. That’s not bad, but if you consider that you can easily purchase a 5%+ CD or US Treasury Bill now, the yield is nothing overly impressive once you consider the work involved. However, what is impressive is the fact that the investor had close to an annualized gain of 13% over 20 years on their down payment of $30,000. Even if they didn’t manage this perfectly and had to come out of pocket $200/month for unplanned expenses, they would still have annualized a return of 10% over 20 years.

Rental Return Projections

Investors get into real estate for the cash flow and then stay for the appreciation, but why do they leave? The typical story we hear is that there is nothing passive about owning rental properties. When you see the potential for a 10% annual return on a relatively stable asset, that gets a lot of people’s interest. One or two houses may not be a gigantic commitment, especially if you use a property manager. However, if you accumulate 5 or more properties, you may eventually start to feel like you’re running a small business. While this might work for you if you’re retired, it can be extremely stressful if you are also working a full-time job and have family commitments.

In conclusion, investing in rental properties can be a financially rewarding venture, but it's not without challenges. It's essential to conduct thorough research, consider your own skill set, and have a solid strategy in place before diving into this endeavor. The "good" of rental property investing, such as consistent cash flow and tax benefits, can make it a valuable addition to your portfolio. However, be prepared for the "bad" and "ugly" aspects typically tied to the property management.

Remember, successful rental property investing often requires a long-term perspective and a commitment to ongoing learning and adaptation. If you stay informed, stay sane, and stay invested you’ll likely reap significant gains and take home your share of the treasure, just like Blondie and Tuco.