The tools available to investors for income tax planning seem to decrease every decade. Unless you are a business owner, there is minimal tax planning one can do to lessen taxes outside of depreciating rental property and maximizing contributions to retirement accounts. Giving assets to charity can be effective, but you are relinquishing control of that money which does not work if you still need those funds. If you struggle with writing checks to the Wicked Witch of the West, better known as the IRS, then Opportunity Zone investing might be of interest to you.

Qualified Opportunity Zone (OZ) legislation was signed into law as part of the Tax Cuts and Jobs Act of 2017. This law designated thousands of areas across the US as low-income communities and created a system where investors can invest within these communities and potentially defer, and in some cases, eliminate future capital gains taxes. Investments made in these areas are not just limited to real estate either. Funds invested into a small business within a qualified OZ may be eligible as well. After selling assets an investor has 180 days to reinvest those funds into a Qualified Opportunity Zone Fund (QOF).

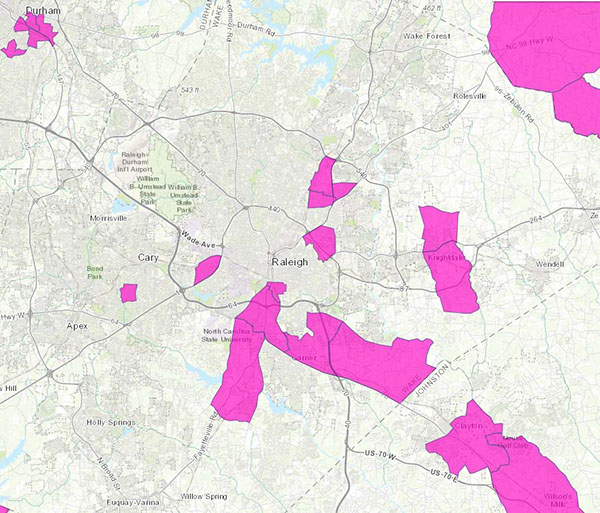

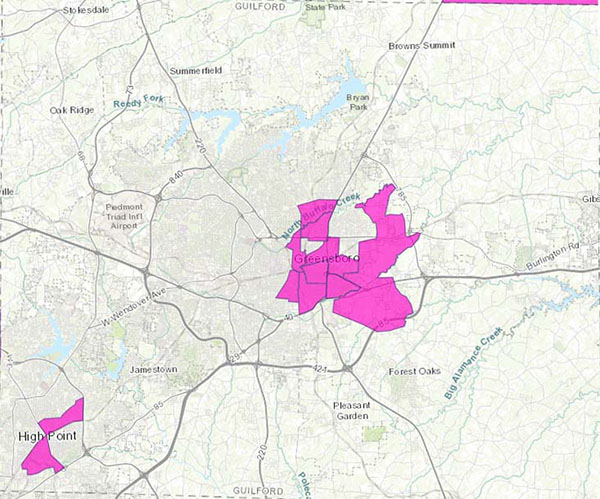

The first step to qualified OZ investing is understanding where these districts are. The real estate or principal location of a business must be located in a designated OZ. HUD maintains this map and has it available online at https://opportunityzones.hud.gov/resources/map. If investing in a small business, the principal location is important. For example, you can’t invest in a cleaning company in an OZ that mostly services houses outside of the area. That business would need to serve the area as well to qualify. In Guilford County (map on back page), a large swath of the downtown area is a qualified OZ, and in Raleigh, there are a handful of areas outside of the inner beltline.

If you roll money from an eligible gain into a QOF, you’ll be able to claim the deferral on your federal income tax return for the taxable year it would have been recognized. If you remain invested for 5 years, then the original tax is reduced by 10% and an additional 5% reduction at year 7. Things get interesting if you remain invested in the QOF for a full ten years. While you’ll have to pay the reduced tax on the original deferred gain, any gains within the QOF are federal income tax-free. For well-executed qualified OZ investments, this can provide incredible potential tax efficiency unavailable outside of anything other than a Roth IRA. These tax benefits can also be paired with local economic incentives and historical tax credits.

Now to the nuts and bolts of qualified OZ investing. Maintaining a QOF is no small task, and all of the guidelines have just recently been put in place, which makes finding robust details on them a bit difficult. Investors have two options. The easier of the two is to invest in a QOF maintained by somebody else. Typically these funds have designated areas they are focused on investing in. The second option is to self-certify and manage your own QOF investments.

Generally, a QOF must invest 90% of its assets in qualified property. For tax purposes, a test must be administrated annually, and it is done by taking the average invested assets at the mid and end point of the year. This is an important thing to be aware of for people who own property in a qualified OZ. Funds may be desperate to put funds to work and look to overpay for real estate assets before critical deadlines.

At first glance it would appear to be a potential loophole to just purchase a quality asset in a qualified OZ and just manage it in order to defer taxes. The writers of the bill thought of this, and put in substantial improvement requirements for OZ investing. Within the first 30 months of a qualified OZ purchase, the fund must substantially improve the property by a factor of 100%. For example, in the case of a $1,000,000 vacant building, there could be a tax valuation where the building is worth $400,000 and the land is worth $600,000. The QOF would be required to put an additional $400,000 of improvements into this property in order for it to remain OZ compliant. So, if you’re going to purchase a qualified OZ property, it is important that you have a vision and the capital for improving it quickly, because if you don’t, you will lose the tax deferral. This requirement can also make investing in qualified OZ businesses more difficult than sticking to real estate where capital improvements are much easier to record and justify.

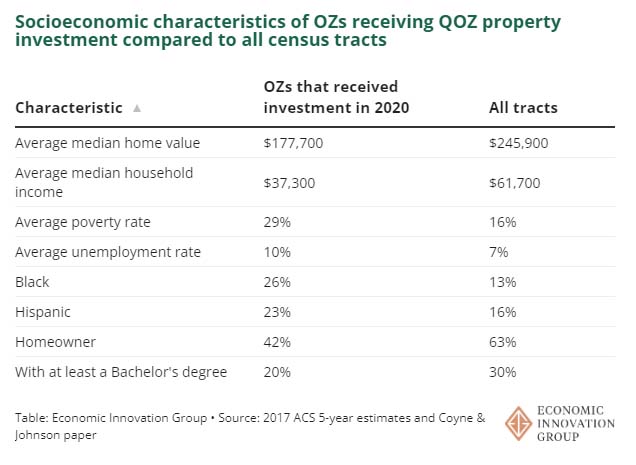

While this is not to meant to be an exhaustive resource on qualified OZ investing, it is easy to see how this type of investment could be attractive despite its complexities. ESG investments focused on social good have made a lot of noise over the past decade, but it has been difficult if not impossible to actually measure the positive social impact from those funds. However, when you see a blighted OZ neighborhood restored, that is something one can see firsthand and know that their investment dollars made it possible. Qualified OZ investing is an interesting niche that seems to fall somewhere between charitable giving and traditional investments. If done correctly one can make the case that this use of capital is more impactful to in-need communities than charitable giving. It requires you actually improve the area, not just spend the money.

Qualified OZ investing has mostly been under the radar since 2017. The bill was initially written to sunset in 2026, so many professionals were reluctant to put time and capital into a structure with a limited shelf life. However, due to its success, there appears to be bipartisan support for this structure moving forward. Expect to hear more about qualified OZ investing as time goes on.

Due to the marketable tax benefits, it is only a matter of time until we see the market littered with funds run by unethical individuals and fraudsters, so the selection of your QOF manager is going to be something of incredible importance. After all, you don’t want to be defrauded by the man behind the green curtain.

Good investments in these communities can also be in short supply, so your manager needs to be ethical, competent, and local. This type of investing is the polar opposite of buying an S&P 500 index fund and requires bold ideas that aren’t for cowardly lions or those with no heart. Most funds have around a $100k minimum investment, and if you’re looking to do this on your own it is advisable to not venture in with less than $1 million due to compliance costs. Rule changes and regulations in this field are sure to be abundant, so stay up to date if you think the yellow brick road to OZ is for you.