Another good stock market year has come and gone. From a corporate perspective, it was a case of the rich getting richer. The companies dubbed the “Magnificent (Mag) 7”, which include the largest 7 tech stocks, increased in value by a whopping 64%. These seven companies carried the S&P 500 index to an impressive 23.3% return and now make up 1/3 of the entire index. However, not everyone thrived like the tech giants. The remaining 493 stocks in the S&P 500 only returned 13.5% on average.

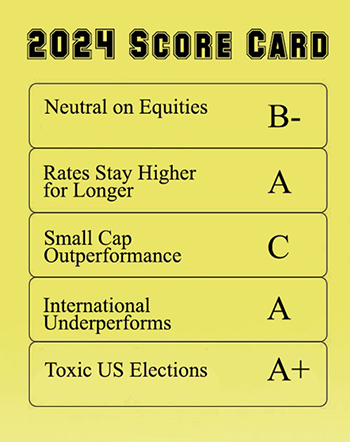

Year in Review—Coming into 2024, we were neutral on equities, and we expected modest positive returns for them. Except for the super-sized returns of the Mag 7, this turned out to be a fairly accurate prediction for the year as most equity indexes (Small, Mid, etc.) were up modestly around 10%. One exception was international equities which continued a historical run of underperformance, posting a return of 5.3%. With the exception of long dated bonds, all asset classes ended up positive for the year.

A large part of our thesis for 2024 was that inflation had not been defeated and that continued Federal deficit spending would limit the ability of the Federal Reserve (Fed) to decrease interest rates. This prediction was very accurate, as the Fed backed off its push for up to 6 rate cuts and pared it down to 3 rate cuts (for a total of 1%). Even after those cuts, long term interest rates stayed stubbornly high. This reaction caused the yield curve to finally un-invert and normalize, which led the aggregate bond market to another anemic performance, gaining only 1.3%. While overall inflation data improved, many internal components continued to be above average; especially housing, which is the largest component of the consumer price index (CPI). Commodities were a bit of a mixed bag last year, with some, such as oil falling 3%, while others, like gold and cocoa, skyrocketed 26% and 178%, respectively.

Our final 2024 prediction was for a toxic Presidential cycle that would lead to increased volatility. To say this was accurate would be an understatement. We saw multiple assassination attempts and the unprecedented replacement of a candidate in the middle of the election cycle. In the end, this didn’t deter markets from having a second straight banner year, and neither should your political affiliation keep you from participating in the growth of your portfolio in 2025 and beyond.

2025 Predictions—After back to back 20+% returns in the S&P500, stocks are essentially priced for perfection, and the index currently sits at a very lofty price to earnings ratio of around 30. From a valuation standpoint, stocks are coming into the year at near the highest ever price to book value ratio. Historically speaking, after two straight years of U.S. stock market gains exceeding 20%, the likelihood of the 3rd year being positive is 67%, with an average return of 7%. While underwhelming compared to recent memory, a low single-digit return for equities is what we expect by year’s end.

However, getting there may be more of a roller coaster than a straight line. 2024 ended with a 5% post election-rally, which was followed by 10 straight negative days later in December. We suspect 2025 will be filled with more volatility of this nature.

The market and political setup looks eerily similar to the early 1980s. The markets ripped higher after the election of Ronald Reagan and large Republican gains in the House and Senate, and they experienced a peak at the end of that November. What followed was a 30% decline in short order. In Reagan’s case, a nearly two decade long bull market followed his clumsy start out of the gate. So, while predicting bear markets is difficult and counter productive to long term investing, the possibility of experiencing one is significant at this market crossroads. The economic animal spirits may continue to juice the economy and the markets, but regulatory overhaul and inflation inducing Federal deficits are difficult hurdles, and even if successfully cleared, it could make for messy markets and higher volatility in the short term.

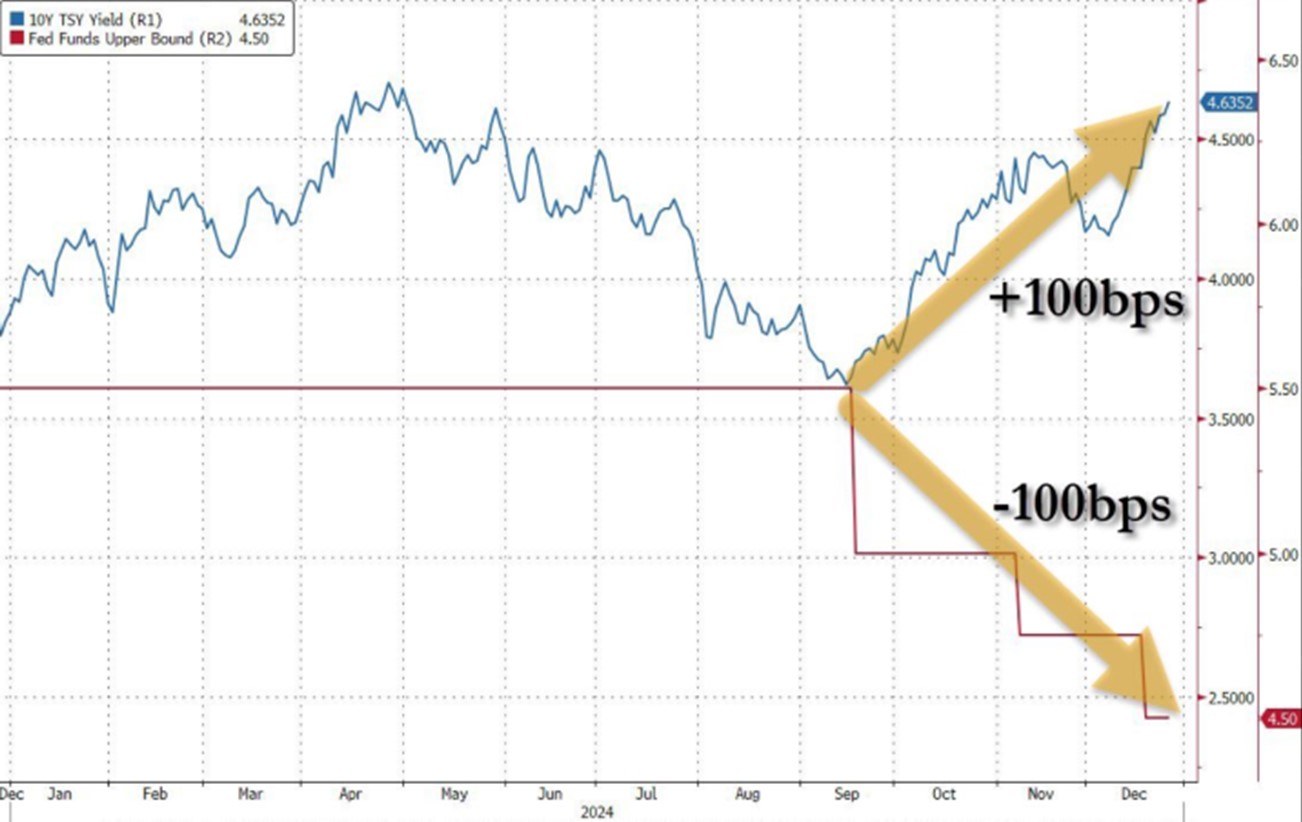

Another potential headwind for the markets in 2025 are interest rates. While the Fed has stated that they are committed to lowering rates further, the bond market is not playing ball with them. The Fed cut short term rates a full percent after September, but longer term rates responded by actually increasing after those cuts. It is debatable if you can even call this a rate cut given the bond market reaction.

We have been carefully following the issuance type of debt over the past year, and almost all of it has been done through short-term means. On a monthly basis, the US Treasury is having to issue close to $3 trillion in short term debt instruments, which is essentially having to turn over the entire debt ($36 trillion) on an annual basis. This is a staggering task, and one that is likely to result in higher rates until the Treasury can figure out a path to successfully sell longer dated bonds again.

A market selloff, even if only 10-15%, could be the path to lower interest rates. This could ignite a flight to quality that typically leads to lower interest rates, and could give the Treasury the cover they need to issue longer dated bonds. Without this occurring, it is hard to imagine a sequence of events where the stock market continues significantly higher from here while interest rates simultaneously drop.

We are also predicting a mild recession for 2025. The driving force of GDP growth over the past year has been via government spending. While we don’t expect the Department of Government Efficiency (DOGE) to be overly successful at cutting government waste to the bone, it does seem to be a backdrop for decreased growth at the Federal spending level. Pair this with continued weakening job reports, and we have the recipe for a flat GDP over the course of 2025.

Another canary in the coal mine for global recession is China. While it is difficult to extrapolate much from their data due to notorious manipulation, it is hard to ignore the yield on their 10-year bond which has hit an all-time low of 1.6%. Continued weakness in their heavily overbuilt and debt-laden real estate sector could lead to significant banking issues in China that in turn lead to economic and political issues in the country. This drag on global growth may be too much for the rest of the world to swallow and still maintain positive growth.

On the domestic side, while we don’t expect another banner year from the market and the tech giants in general, we expect small and mid-cap companies to out-perform. Potential tariffs from the Trump administration and a continued focus on on-shoring the supply chain are more likely to affect the multinational global companies than those conducting most of their business inside the U.S. That as well as overall valuation disparity should give a leg up to smaller domestic stocks and those more aligned with value vs. growth.

While our 2025 predictions are far from rosy, it is important to not steer too far from long term equity allocations. Even if we enter a recession and a bear market, it could potentially last for only a few months a la the Covid-induced 35% drawdown in 2020, and then be back to the races. With advancements in artificial intelligence (AI) and robotics it will be difficult to predict how corporate efficiency and job displacement balance with each other over the remainder of this decade. It very well could be a positive for the stock market and corporate profitability while simultaneously being a drag on GDP and the overall economy in the short-term.

Our current suggestion is to be 10% below long-term targets in equity (e.g. 60/40 instead of 70/30) and overweight in cash. Cash yields over 4% currently, so don’t look at it as dead weight. Use the coming year as an opportunity to put cash back into the markets opportunistically during times of volatility, and buckle up for the ride!