It is hard to believe that we are already a quarter of the way through the 21st century. It is even harder to believe that if you have older quarters made of silver, they went up 140% last year! Examples like this made 2025 into a year that stock picking mattered again. Many broad indexes were up 15% or more, but if you dabbled in individual positions you could have easily been either up or down 50% for the year. Will 2026 be another year for active management, or will the index investor be king again?

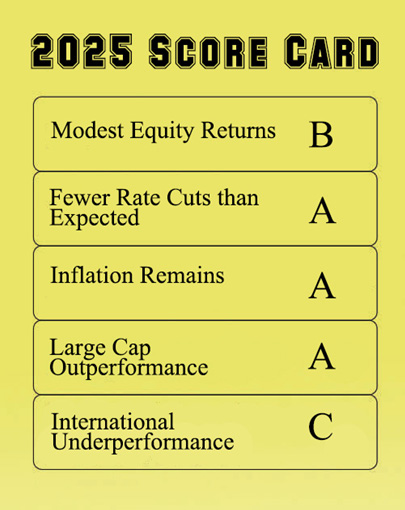

Year in Review—Considering so much of the market action of 2025 was driven by the Artificial Intelligence (AI) trade, we thought this would be a great time to let one of the AI engines (Google’s Gemini) grade our predictions for last year. Overall, their system gave us a “B+” on our predictions, and to us that sounds fairly accurate.

Coming into the year we were neutral on stocks and suggested being 10% lower on equity exposure until a market selloff. The selloff came in the first quarter with the indexes losing around 20% on the back of Trump’s aggressive Liberation Day tariff policy. On April 9th, Trump announced a pause on tariffs, and the markets responded with one of the greatest single daily rallies ever — about 10%. This strength continued into the remainder of the year with all major stock indexes up double digits for 2025.

Another accurate prediction was our belief that the Federal Reserve would cut interest rates much less than expected. At the start of 2025, market pundits expected 6 interest rate cuts, but we disagreed with this sentiment. We believed that excess government spending would make it difficult for the Federal Reserve (Fed) to cut short term rates below 3% and at the same time maintain its stated inflation target rate of 2%. Consequently, the Fed only cut rates 3 times and didn’t start the reductions until September.

The most fascinating grade from Gemini is the “A” it gave us for predicting large-cap out-performance in 2025. While the out-performance was real, the prediction was not! We actually predicted that mid-cap and small-cap stocks were due to finally take the lead in 2025. And while the smaller market cap stocks returned double digits, their increased exposure to tariff costs and lack of AI exposure led to relatively less gains than large-cap companies. This is a continuing reminder for everyone to double check results when utilizing AI!

International stocks were the biggest winner of 2025 returning 30% on the whole. This was their widest margin of outperformance since 2009. A weakening dollar that lost 10% of value and lower beginning valuations led to overseas success. Gemini gave us a “C” on this prediction, but that seems fairly generous in our opinion.

2026 Predictions—After multiple yearly double digit returns in the S&P 500, stocks are still priced at historically high valuations. In other words, the market Price/Earnings Ratio is assuming that corporate earnings will continue to grow at such a fast pace that the financial fundamentals will catch up with the stock price eventually. Being priced for perfection, means it wouldn’t take much of a hiccup to generate another 10-20% correction in 2026.

What might cause this economic hiccup? One pitfall we see is the potential for another mini banking crisis similar to what we saw in 2023. Since 2020’s journey down to zero percent interest rates, there has been an abundance of liquidity in debt markets that has sustained unprofitable businesses. Consequently, the private debt market has issued loans to marginal corporate clients with lax underwriting standards. We expect investors to begin looking more closely at these debt structures in 2026. JP Morgan CEO, Jamie Dimon recently commented that “cockroaches were lurking in opaque corners of the private credit market,” and we believe this alarm is justified. We see some private credit funds that are already struggling with this issue and have published book valuations priced about 30% higher than what they are actually worth.

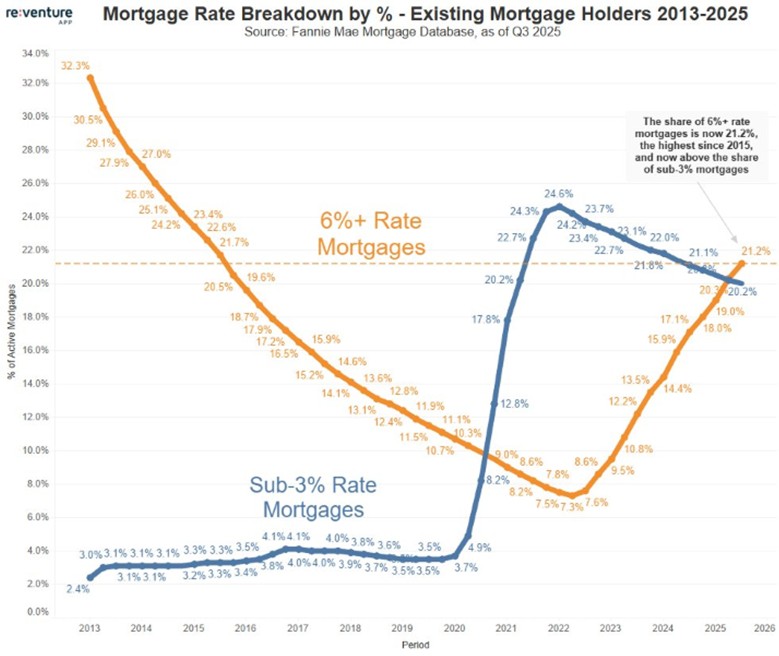

The second leading factor that could cause issues for the banks is a continued softening of the real estate market. While we have written numerous times about the imminent danger in the commercial office space, the residential real estate market has held up remarkably. For 2026, our expectations are for a single digit drop in housing prices in the US, However, individual areas could see 15% or more depreciation. Late last year a COVID-era loss mitigation option sunsetted. Prior to that, those with FHA loans could skip all payments and then roll the missed amounts back into their loan principal, penalty free. By our analysis we think 1-2% of all homes have been in some form of loan forbearance and will begin to enter foreclosure over the next 18 months. Additionally, we have also crossed a point where more people have 6%+ mortgages than under 3%. This balance should lend to the continued dethawing of markets, increased supply, and lowered prices.

While we expect these noted banking issues, we currently do not see large systemic issues to worry about. For the first time in decades we have a normalized interest rate structure, which is a positive for bank profitability. We expect few changes to the interest rate environment regardless of whomever comes in to head the Fed when Chairman Powell’s term ends in May. The Trump administration may want lower rates, but with Congress running an annual budget deficit of $2 trillion, we just don’t see significantly lowered long-term rates in the cards. In fact, since the Fed began cutting short-term rates last year, long-term rates have actually gone up!

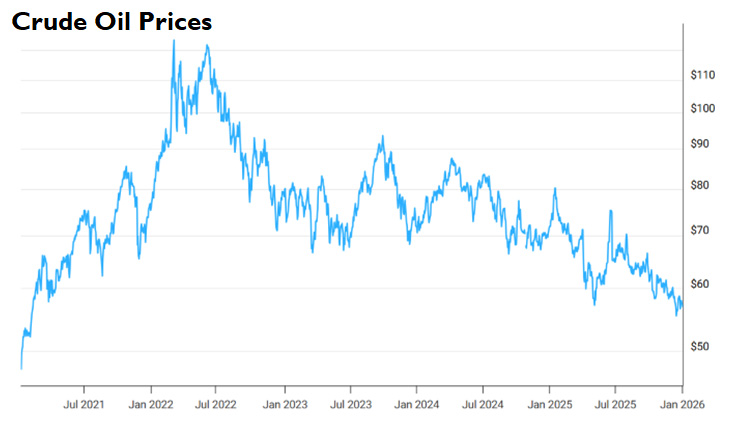

Some of the wildest market action in 2025 was in the precious metals markets. Gold was up another 65% after putting up a 26% return in the prior year. The common wisdom has been that inflation and dollar debasement has been the cause for this huge upswing in metals. However, if that was the case then why aren’t we seeing all time highs in oil and gas prices as well? Currently, crude oil prices are sitting at close to 5 year lows. We expect this performance gap between oil and gold to close this year, but we aren’t really sure in which way. Oil returning to $100/barrel seems to be the most likely economic outcome, but I’ll have to tune into the rest of Season 2 of Landman to find out.

Could 2026 be a year of change in market leadership? Big tech and the AI trade was still a winning trade last year, but some cracks seem to be showing. The technology seems to be ready, but the data centers and energy resources needing to support it have some catching up to do. Additionally, Open AI, the front-runner in the space, is expected to do one of the largest IPOs in history sometime in 2026. When this happens, it could be a contrarian indicator that a near-term top in valuations is in.

A change in US market leadership could be a continued windfall for international stocks in 2026. Even after a great year in 2025, the valuation of every sector in the US is still quite a bit loftier compared to overseas peers. An aggressive and constantly changing tariff policy in the US has the potential to shift investments overseas further in 2026. Whether the tariffs are a positive for the US economy is still a heated debate, but the emergency provisions under which they were enacted seems likely to be reversed, with the Supreme Court set to potentially rule on the matter early in the year. This lack of clarity and continuity on the matter could further benefit the international versus domestic stocks.

2026 is a mid-term election year, which historically has been a difficult time for investors. The S&P 500 has finished higher just 53% of the time with an average gain of just 4.6%. For comparison, in the other 3 years of the presidential cycle, the S&P 500 has finished up 78% of the time with an average gain of 11%.

While we have more negative predictions than positive, and the market may revert to the mean in 2026, it is important to remember that investing isn’t a short-term gamble, but a long-term journey. It would be wise not to bet against stocks in the next quarter century.